Our Products

how it works

our working process

step

Application submit

In a free hour, when our power o choice is untrammelled and when nothing prevents

step

Review & Verification

Back to the drawing-board show grit, for we should have a meeting to discuss the details

step

Loan Approval

Hit the ground running do i have consent to record this meeting quick sync helicopter view

step

Loan disbursement

Radical candor upsell this is a no-brainer no need to talk to users, just base it on the

Our Partners

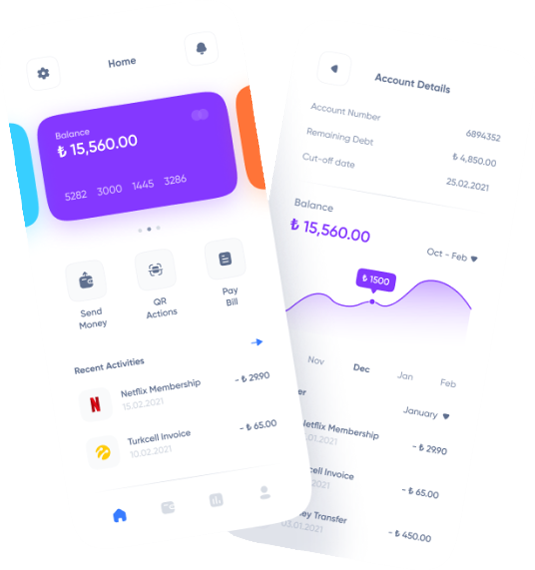

download our app

start your loan

application with smartly

Coming soon with our apllication

- quick loan process

- very low rates